Fast Home Loans

Low-Interest Rates

Personal Attention

Fast Home Loans

Low-Interest Rates

Personal Attention

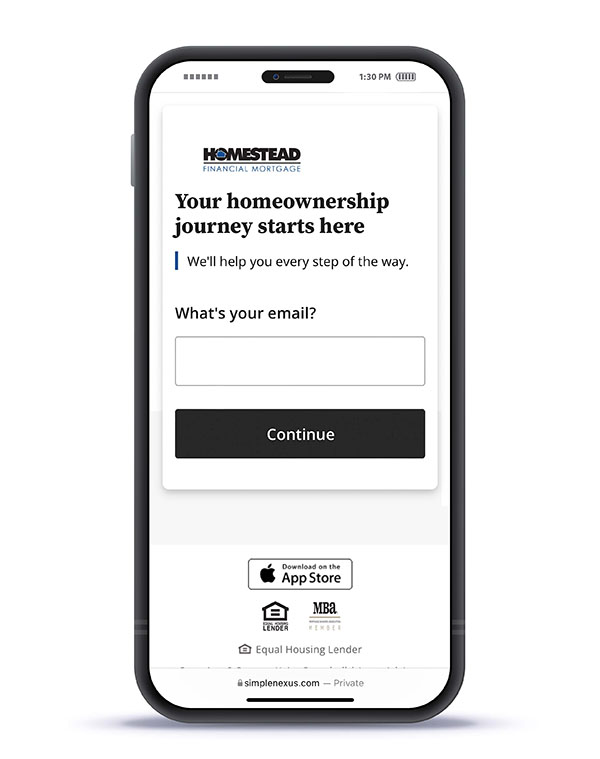

Homestead Financial Mortgage

Whether you’re purchasing or refinancing a home loan, we will meet your deadlines & exceed your expectations.

Home Loans Done Better

Tell us what you need, and we’ll get you there.

- A fast close? No problem.

- Need extra time? We can do that too.

- Want to apply for home loans from your couch? It’s easy.

- Prefer to come into the office? We’re here for you 7 days a week, including nights & weekends.

Here are the six simple steps you’ll follow:

- Apply online or give us a call

- Upload your documents or bring them in

- Get pre-approved

- Go shopping (If refinancing onto step 5)

- Fill in any details for Processing & Underwriting

- Close on your loan

- Jayson Hardie on Growth

Get a Free Quote →Big Advantages of Choosing

Homestead Financial Mortgage

Low-Interest Rates

You’ll get some of the lowest loan rates & fees in the state.

Personal Service

Your loan advisor will make your home loan process easy.

You’ll Close on Time

Tell us your deadlines & we’ll get you there on time.

Stress-Free

Relax & breathe - you don’t need to worry about your financing.

24/7

We’re available when you need us, including nights & weekends.

We’re Local

Serving St. Louis, MO; Overland Park, KS; Godfrey, Glen Carbon, & O'Fallon IL; Dallas, Texas.

Learning Center

Reasons to Refinance Your Mortgage

With mortgage rates remaining near record lows, you may be considering refinancing your current mortgage to lock in a lower rate or tap into your home equity for renovation projects.

Home office, anyone?

How Long Does It Take to Get a Mortgage?

For a purchase, Homestead Financial Mortgage can close in 14 days and 30 days for a refinance. Most other lenders take 30 to 45 days for purchase and 60 days for a refinance.

Here are the six basic steps to getting a mortgage.

4 Big Tips for First-Time Homebuyers

Buying your very first home is such an exciting time! But it can also be a bit intimidating. It doesn't have to be. Here’s why – you don’t need to have everything figured out. There are just a few points to have in place to get you started on your way to owning a home. Read on to see what they are.