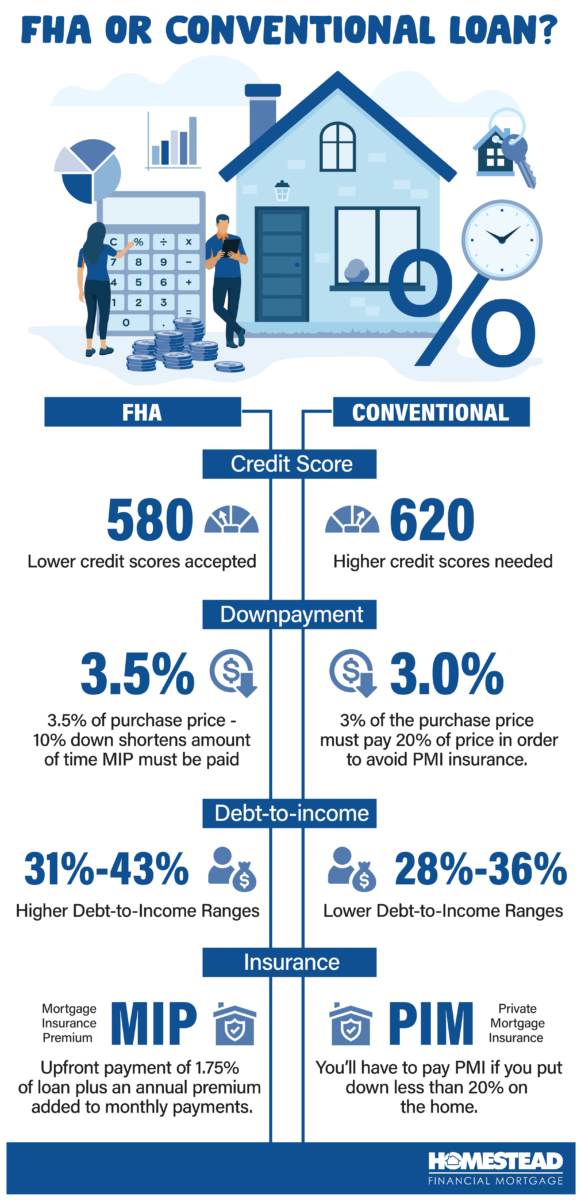

In today’s market, 4 types of mortgage loans are available: Conventional, FHA, VA, and USDA. Of the 4 mortgage types, FHA and Conventional loans are the most common, so we’ll cover those. VA mortgages are only available to US Veterans, and USDA mortgages only apply to certain homes in USDA-sanctioned zip codes).

To make it easier to understand the differences between FHA and Conventional – let’s look at it through the 4 C’s of mortgage underwriting criteria:

- Credit – Credit history and FICO/credit score as it is reported by the 3 credit companies, Trans Union, Equifax, and Experian.

- Capacity – The capacity to repay the home loan.

- Capital – The amount of funds saved for down payment and reserves.

- Collateral – The value and marketability of the subject property.

At a high level – FHA loans are better for first-time home buyers with below-average or troubled credit. FHA loans are also better for those with limited capital for a down payment. FHA loans can be a little harder to obtain in areas other than credit. There is more red tape with an FHA loan, and the rates are a little higher.

Conventional is better for people with higher credit scores and/or above-average capital. Due to the strength of the credit of a conventional borrower, there is less red tape. Conventional loans have the best mortgage rates and are easier on the collateral.

Framing the FHA vs Conventional Guidelines

In order to speak in great detail, we should discuss Desktop Underwriter (DO) and Loan Prospector (LP). These are the computer databases that underwrite the loans to FHA or conventional guidelines. Fannie Mae and Freddie Mac are the entities that make and insure a majority of conventional loans in the US.

FHA, Fannie Mae, and Freddie Mac set forth guidelines to which mortgage bankers like Homestead Financial Mortgage underwrite. So, in other words, they set the rules of the game, and we play by them.

Conventional Mortgages

The Government Sponsored Enterprises (GSE) Fannie Mae and Freddie Mac dominate the conventional mortgage market. A GSE is an entity created by the government with specific advantages granted by the government. The GSE’s advantages are used to support the common good. In this case, their underlying goal is to promote home ownership but also to be profitable.

Credit:

Credit must be above average (700) if your Loan to Value is over 80%. There can be no major late payments in the last 2 years. Bankruptcies must be over 4 years old, and foreclosures must be greater than 7 years.

Capacity (Income):

Income must be stable for the prior 2 years and looking forward. The job history time can include being a full-time student, provided that the new job is in the field of study.

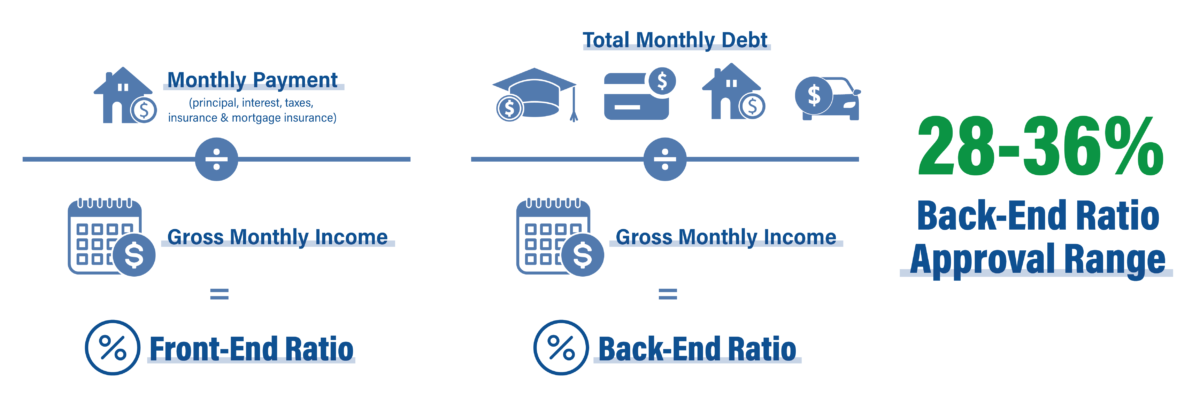

The monthly income is put into the denominator to start the calculation of the front and back debt-to-income ratios. The monthly payment of principal, interest, taxes, insurance, and mortgage insurance (PITIMI) is then put into the numerator. The percentage is called the front-end ratio.

All other payments on the credit report are added to PITIMI to obtain the back-end ratio.The debt-to-income underwriting standard for conventional loan approvals has been 28%-36%. However, we commonly see approvals with a backend ratio above 45%.

Capital:

If your score is below 700, you should be expecting to put 20% down on your purchase. If you do not have 20% equity, your score likely needs to be above 700, and you will need to expect to pay Mortgage Insurance. Private Mortgage Insurance (PMI) can be canceled on a conventional loan once you’ve paid past a certain amount on your loan. PMI is driven by credit score, and it starts to get expensive below 700. Putting 15% isn’t terrible, although at that point, you might be better off going with FHA.

The availability of capital in the form of down payment or reserves is what is called a compensating factor. Compensating factors are what allow for flexibility of higher debt-to-income ratios.

The funds for a down payment can be gifted, and the audit trail to support the gift is relatively easy. Just make sure to check with your tax provider on the implications of gifting a down payment.

Collateral:

This is where conventional applications can be much easier. Due to the data available, there are often appraisal waivers or waivers of value given by DU or LP. This greatly improves the efficiency of underwriting a loan.

FHA Mortgages

FHA stands for Federal Housing Administration. Their goal is to promote homeownership. The underlying goal is not to make a profit, but they also cannot operate as too large of a loss. FHA mortgages can be more costly in terms of higher interest rates due to approving those with less than average credit.

FHA mortgages require more administrative red tape. Each application gets an FHA case number, a CAIVRS report, and a Limited Denial of Participation (LDP) / General Security Agreement (GSA), all obtained from the FHA connection. For borrowers who can’t clear one of these reports, more work is required on the mortgage application.

FHA mortgages also have a loan limit based on the Metropolitan Statistical Area (MSA). Since the goal is homeownership, FHA will not help a wealthy person buy their “luxury” home.

Credit:

In general, a borrower must be above 600 and have no major late payments in the last year. Bankruptcies must be over 2 years old, and foreclosures need to be greater than 3 years.

Capacity:

Income is computed, and requirements are very similar to conventional. Income must be stable for the prior 2 years and looking forward. The job time can include full-time student provided that the new job is in the field of study.

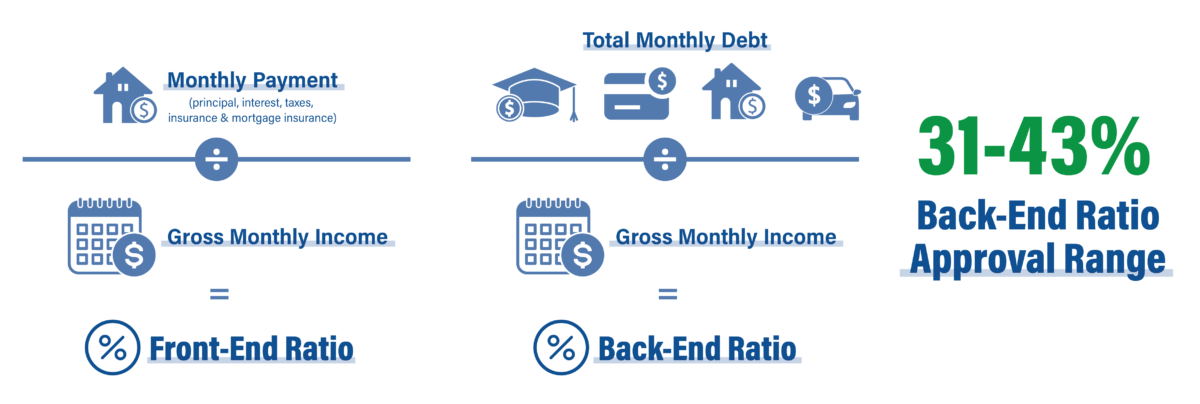

The computation of the front and back-end ratios is the same as conventional. The debt-to-income underwriting standard for FHA loan approvals has been 31%-43%. However, we commonly see approvals with a back-end ratio above 50%.

Capital

An FHA loan has low down payment requirements. They approve a purchase of a home with as little as a 3.5% down payment. The funds for the down payment can be gifted, but the audit trail to support the gift is more complicated than on a conventional loan. For FHA loans, the donor must submit proof of ability to donate the funds. So, in other words, if Mom and Dad are gifting your down payment, we need to see their bank statements.

Like conventional, capital in the form of a down payment or savings is a compensating factor. Compensating factors allow for higher debt-to-income ratios to be approved. FHA also allows for 6% seller concessions to pay for a buyer’s closing costs and prepaids. This is more than conventional with most buyers. With a borrower who has a limited amount of money to put down, the additional concessions help get some purchases closed.

Collateral:

FHA requires a full appraisal on nearly all applications, with the exception of an FHA streamline. An appraisal logging system also keeps records of previous values and details. An FHA appraisal is a more in-depth appraisal than a full conventional appraisal. The appraisal logging system keeps records of details, fair or unfair, which can create more issues.

FHA vs. Conventional Cost Comparison

The main area of difference between the cost of FHA and Conventional loans is Mortgage Insurance costs. FHA charges an upfront Mortgage Insurance Premium (MIP) – typically 1.75% of the loan amount regardless of the down payment percentage. This can be paid upfront or added to the loan balance. FHA also charges an additional annual payment typically added to your monthly payment. This insurance payment will be for the life of the loan unless you put 10% down. Conventional loans only require borrowers to pay Private Mortgage Insurance (PMI) if their down payment is less than 20%.

Conclusion

While some borrowers believe that FHA loans are best for a first-time buyer and Conventional for more established buyers, both types of loans have their own unique advantages to any borrower. Conventional mortgages have standards that are harder, but the mortgage interest rates are lower. FHA loans help borrowers get a home with less down and with more forgiving standards, but they are a little more costly due to required mortgage insurance. The prevailing strategy we often see is purchasing your home with an FHA mortgage and refinancing to a conventional loan when the time is right.