If you’re applying for a mortgage in 2023, in a rising interest rate market, then it’s likely out of necessity. If it’s for purchasing a home, a 2nd mortgage, or a cash-out refinance for debt consolidation or cash flow improvement, you don’t expect to be a mortgage turndown. To ensure you are approved and have the smoothest process possible, it’s important to work with a good mortgage banker—not a just bank that also does mortgages. Here are some tactics great mortgage lenders, like Homestead, will use to win approvals for their borrowers.

Help Raise Your Credit Score

Many turndowns are due to low credit scores. Your credit score is used as a proxy for how likely you are to pay back the debt. For a mortgage lender to approve you for a 1st mortgage, the score cutoff is around 580, while for a second mortgage, it’s 720.

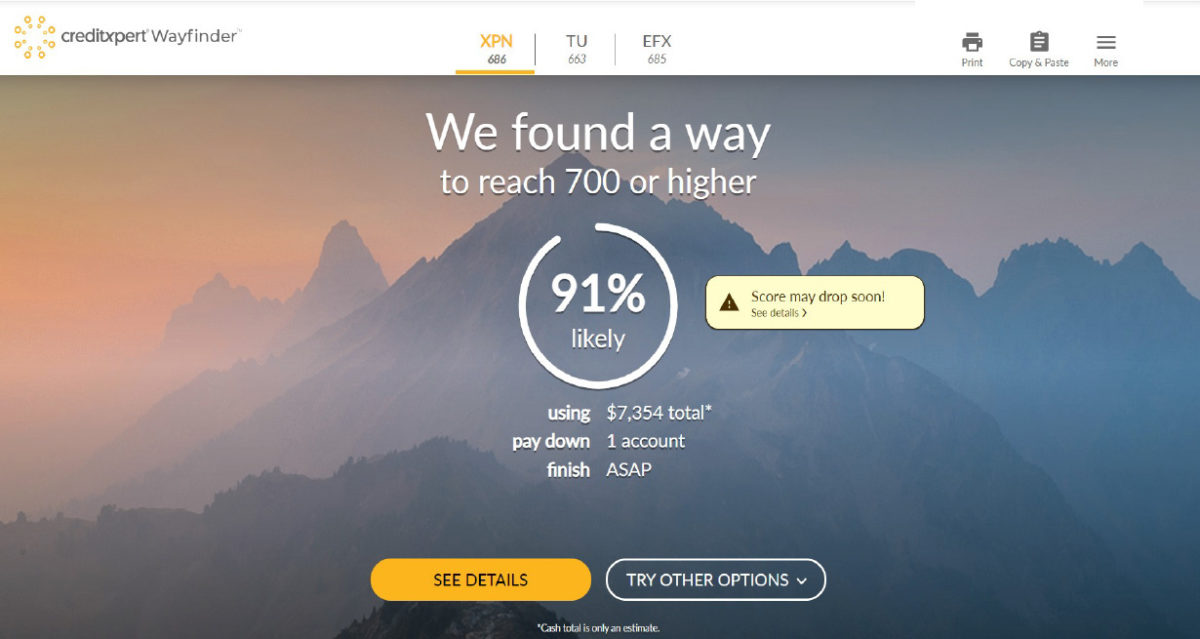

If your credit is close to a cutoff, we use credit improvement/optimization software to check “what if” scenarios for our borrowers. We can often see a 50-60 point swing with small financial investments such as catching up an unknowingly late account, paying off small collections, or lowering the proportion of credit utilized to the credit limit on the card.

Remove a Spouse From the Mortgage Application but Keep Them on the Title

Sometimes, one spouse has a detrimental score (below the cutoff mentioned above) or debt-to-income contribution. One way to get the application approved is by keeping both spouses on the title but removing one from the mortgage application. By doing this, the financial goal of the household can be met without sacrificing any legal right to property.

Exclude a Co-Signed Debt From Consideration

Have you ever co-signed on a car loan or credit card for someone else? If so, lenders can omit that debt obligation from the underwriting consideration if the co-signed can produce proof of payment for 12 months.

Is That All?

This isn’t the full list of hacks we use, just a sneak peek. Remember, by using a mortgage banker and not just a bank that also does mortgages, more time is devoted to ensuring your loan gets approved. If you have questions or are ready to apply for a mortgage – let us know. At Homestead, we only deal with mortgages, so we will do whatever we can to ensure you qualify.