Let’s face it, getting a new mortgage probably isn’t on the top of your “Fun Things to Do” list. But, regretting not getting one is worse. That’s why at Homestead, we make getting a cash-out refinance fast and easy.

And since you’ve been procrastinating and putting refinancing off, you’re probably wondering . . .

What will interest rates Do?

To begin with – nobody knows for sure. But rates have stayed down the last five years. So, they will eventually go up. But – don’t freak out. Here’s why.

A ¼% rate increase doesn’t make that much difference in your payment. Here’s an example:

Have you checked your home’s value lately?

And, if you’re like most homeowners, your equity has increased quite a bit over the last few years. That means, the more equity you have, the more cash out you can get. Plus, your rate could be better too.

In addition, that’s another point in favor of refinancing now when the market is hot. Keep in mind, that if prices start to dip, so will your equity and the amount of money you can get.

The Best Ways to Use Your Equity

When you get a cash-out refi, you pay off your existing mortgage with your new loan. And you receive a lump sum at closing. Consider how you want to use your funds. Ask yourself:

Can I increase my home’s value even more?

How does your house compare to other properties in the neighborhood? Is yours dated with a kitchen from the ‘80s? If that’s the case – investing back into your home – without “over improving” is a smart way to use your funds.

Could I reduce financial stress by paying off debts?

How would you feel if you paid off your high-interest loans? Does just the thought make you breathe a sigh of relief? If you’re struggling with your monthly budget, using some or all of your funds for debt consolidation could be a good idea. That is – as long as you change your spending habits.

Which home improvements would make my home more enjoyable?

If your floorplan is dated, how about knocking out some walls and opening it up? Open floor plans can transform the look of a home.

Is your home hot, cold, or drafty? When that’s the case it’s smart to think about new energy-efficient windows, upgraded insulation, or a new HVAC system.

Would I like to have money to invest?

Getting cash out of your home is an excellent way to come up with the funds for a second home, vacation home, or rental. And for those who like to invest in the stock market, you can also invest in an S&P fund for higher returns.

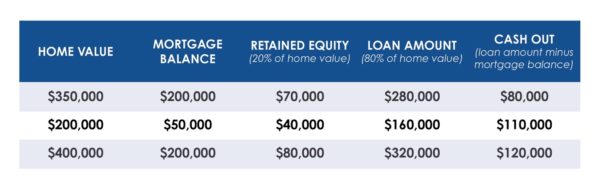

Check Out These Cash Out Scenarios

It’s Time to Improve Your Financial Life for the Better

The team at Homestead Financial Mortgage is here to help. We can close a refinance in 30 days. Contact us today, and in just a few minutes, you can learn about your options.

YOU MIGHT ALSO BE INTERESTED IN THESE ARTICLES:

How to Qualify for a Self-Employed Mortgage

How Long Does It Take to Get a Mortgage?