If things have changed in your savings and spending habits over the last few years you are not alone – there have been significant changes in both savings and credit card debt trends nationwide. Understanding these trends can help individuals and families make informed financial decisions and plan for the future.

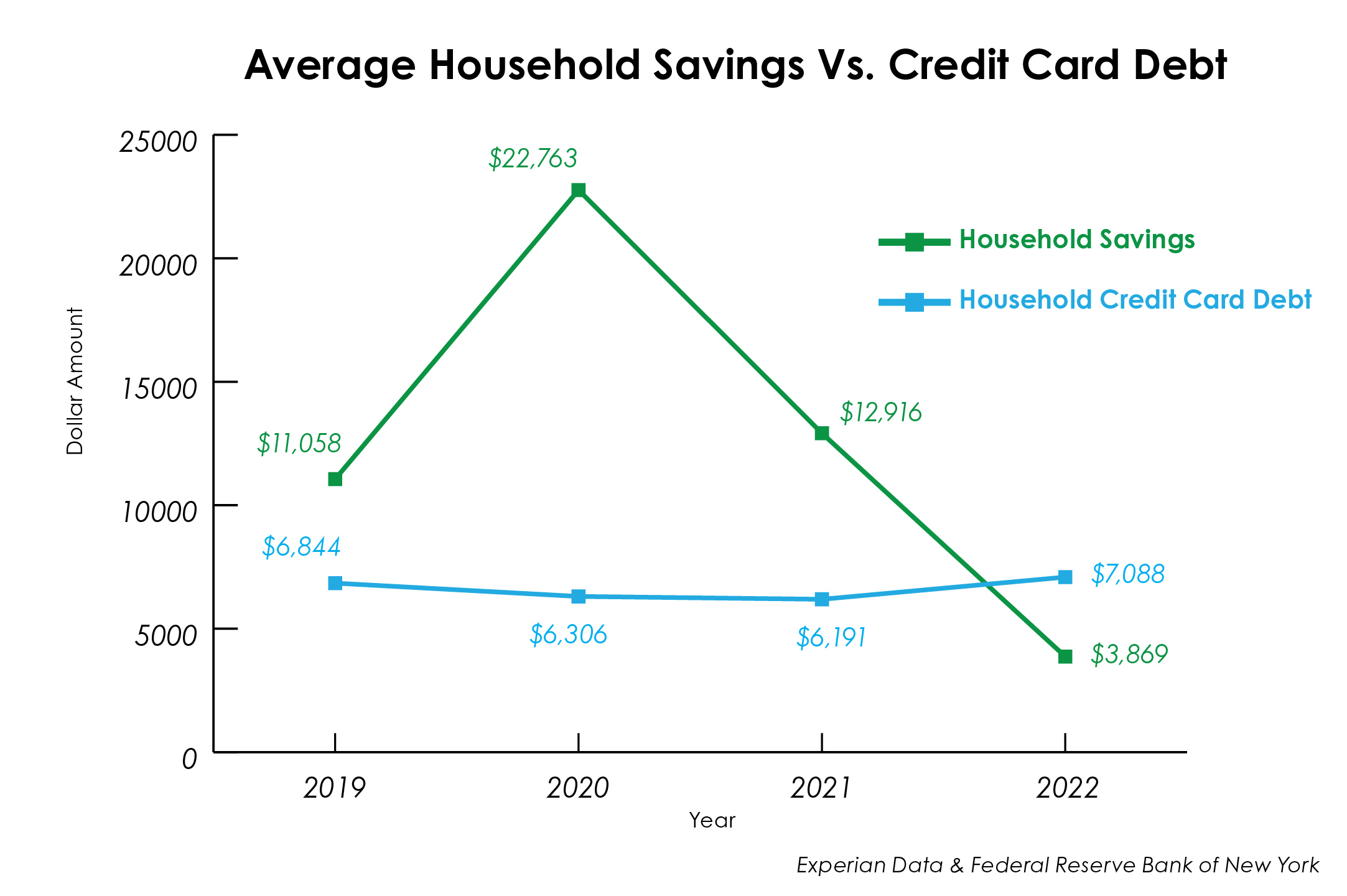

In 2019, the personal savings rate in the United States was around 8.8%. This means that, on average, individuals were setting aside 8.8% of their disposable income for savings. By 2020, the personal savings rate had increased significantly, reaching a peak of 33% in April of that year. This trend was likely driven by the economic uncertainty and financial insecurity caused by the COVID-19 pandemic, as many people were forced to cut back on spending and save more in case of job loss or other financial setbacks.

After the pandemic, Americans began borrowing heavily again to keep up with decades-high inflation on essentials such as food, gas, and housing. Credit card balances saw a $38 billion increase since the second quarter, a 15% year-over-year increase – its fastest clip in more than 20 years, according to the Federal Reserve Bank of New York.

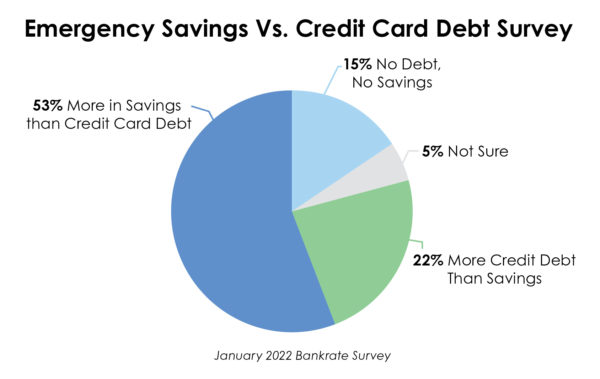

Only a little over half (53 percent) of U.S. adults have more money stashed in an emergency savings fund than they’ve racked up in credit card debt, the January 2022 survey of more than 1,000 U.S. adults found. More than 1 in 5 (22 percent) U.S. households carry more credit card debt than the amount they have saved for unexpected expenses. The good news is that number is down 5 percentage points from Bankrate’s January 2021 emergency savings survey.

Only a little over half (53 percent) of U.S. adults have more money stashed in an emergency savings fund than they’ve racked up in credit card debt, the January 2022 survey of more than 1,000 U.S. adults found. More than 1 in 5 (22 percent) U.S. households carry more credit card debt than the amount they have saved for unexpected expenses. The good news is that number is down 5 percentage points from Bankrate’s January 2021 emergency savings survey.

With the Fed rapidly raising interest rates to contain inflation, families are feeling the pinch of higher borrowing costs, too. Average credit card rates, at 18.7 percent, are at their highest level in 30 years and will probably continue rising, according to Bankrate.

One solution to help eliminate credit card debt and increase savings is to consider a cash-out refinance. This is a type of mortgage refinance in which a borrower takes out a new loan, typically with a lower interest rate, to pay off existing debts, including credit card balances. By refinancing with a cash-out option, a borrower may be able to pay off their credit card debt and use the remaining funds to increase their savings.

It is important to keep track of both savings and credit card debt trends, as they can have a significant impact on financial stability and long-term financial planning. By understanding these trends and considering options like a cash-out refinance with Homestead Financial Mortgage, individuals and families can make informed decisions about spending, saving, and borrowing, helping to ensure a secure financial future. Give us a call; it costs nothing to find out your options.