Credit scores range between 300 to 850. The higher your score, the better. For a mortgage, you’ll need a score of at least 620 to start. When you get into the 700s, you’ll get a better rate.

Three leading credit reporting companies are.

Each of these agencies generates a credit score. The resulting scores are usually not the same. The mortgage lender will use the lowest middle score among the borrowers.

For example, if a husband and wife are applying and the husband’s middle score is 700 but the wife is 620 – the lender would use 620.

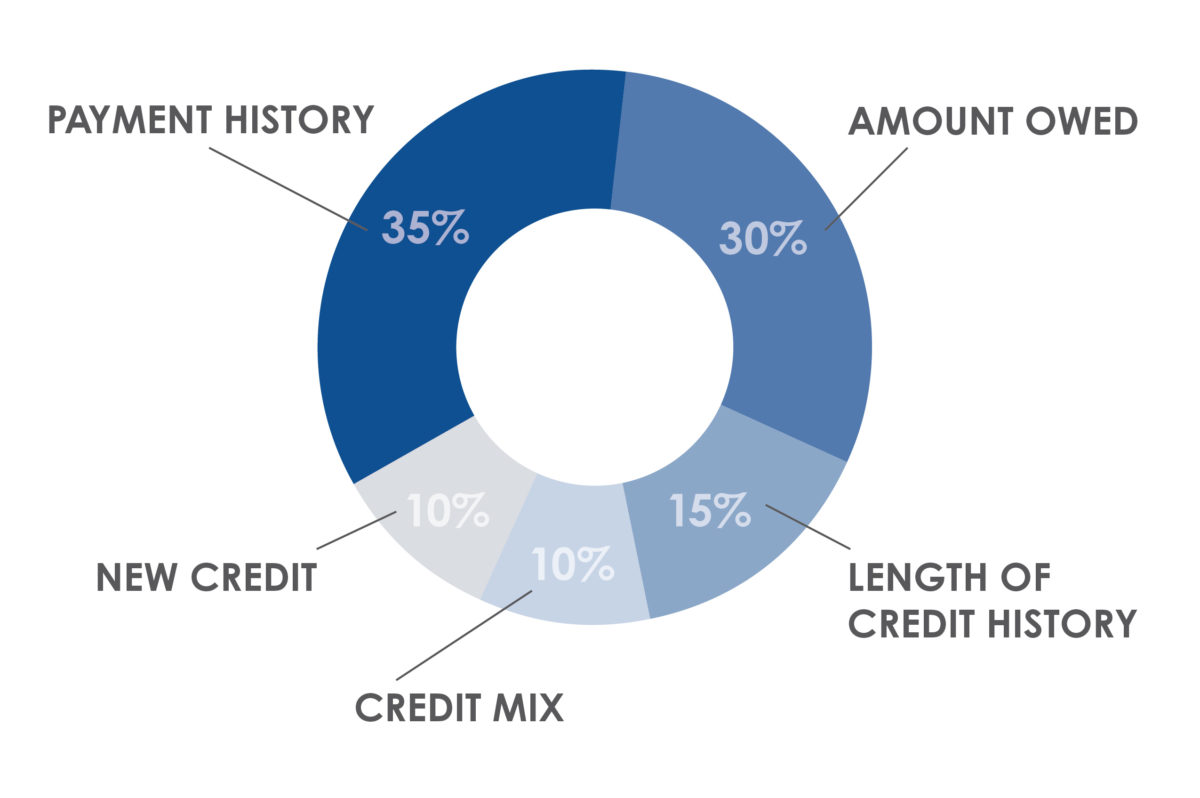

Besides your score, the lender will look at your credit history. Here are the five factors that make up your credit score.

Knowing how your score is calculated can help you improve your score with good spending and payment habits.

#1 Payment History = 35% of Your Credit Score

It includes information reported from credit card accounts, retail store accounts, installment loans, mortgage loans, and more.

#2 Amount Owed = 30% of Your Credit Score

It’s the ratio between credit used vs. credit available or what’s owed now compared to the original loan amount.

#3 Length of Credit History = 15% of Your Score

It’s how old your accounts are and the total average age of those accounts. Don’t close old credit cards – that could lower your score.

#4 Credit Mix = 10% of Your Credit Score

This reflects the type of accounts you have and how you manage them. If you’re trying to establish credit, start by opening one credit account. Make your payments on time before you add more credit lines.

#5 New Credit = 10% of Your Credit Score

This reflects new credit and the number of recent inquiries. Too much new credit or recent inquiries can lower your score.

Homestead Financial Mortgage can pull your credit and let you know your score. If it’s too low, we’ll work with you to help you increase it. And keep in mind that your score doesn’t have to be perfect. It just needs to be good enough to get you your loan.

It’s our job to get you from where you are to where you need to be. Our low-interest home loans are some of the best in the states we serve. We’re licensed in Arkansas, Colorado, Florida, Illinois, Indiana, Kansas, Kentucky, Missouri, Montana, Ohio, Oklahoma, Tennessee, Texas, and Wisconsin.