When it comes to purchasing a home, there are different ways to go about it. There are several loan types and lenders to choose from – and they all provide specific benefits for you as a borrower. One lesser-known option that buyers and sellers alike can consider is the assumable mortgage loan. We’ll explore what assumable mortgage loans are, their benefits and disadvantages, as well as some alternate options to consider when trying to buy a home at a lower interest rate.

What is an assumable mortgage?

An assumable mortgage allows a new homeowner to step not only into a new home but also essentially into the shoes of the seller on their mortgage. The buyer assumes responsibility for the remainder of the mortgage terms, including interest rate and remaining balance. This is an especially appealing way to purchase a home when interest rates are high. If the loan was a 30-year term at 3% and has 20 years remaining, the new buyer will be taking over those exact terms. The only thing that is changing on the mortgage is the name – everything else stays the same.

What mortgages are assumable?

Not all mortgages are assumable. Most conventional mortgages are not. Loans backed by the Federal Housing Administration (FHA), Department of Veteran Affairs (VA), or the U.S. Department of Agriculture (USDA) are assumable – as long as they meet certain requirements.

How do assumable mortgages work?

An assumable mortgage requires the lender’s approval. You will reach out to the current lender that holds the mortgage for specific instructions, which could take up to 60-120 days. If mortgage assumption is made informally and the lender finds out – they can demand payment in full immediately.

In a proper assumption, the new borrower still needs to complete many of the typical requirements of qualifying for a loan. They will still need to provide financial and employment information, and they will have to have a credit check done. If the original loan was for $400,000 and $300,000 remains, the buyer is responsible for the remaining payments on the $300,000 as well as owing the sellers the difference between the current home value and the remaining balance.

Benefits of Assumable Mortgage Loans

Favorable Interest Rates: One of the most significant advantages of assumable mortgage loans is the potential to secure a lower interest rate than what’s currently available in the market. If the seller’s interest rate is lower than the prevailing rates, the buyer can enjoy substantial savings over the life of the loan.

Lower Closing Costs: Assuming an existing mortgage can also lead to lower closing costs compared to obtaining a new mortgage. Traditional mortgage transactions involve various fees and expenses, such as loan origination fees, appraisal fees, and title insurance. With an assumable mortgage, these costs are often reduced or even eliminated since FHA, VA, and USDA impose limits on these fees, and an appraisal is often not required.

Faster and Easier Qualification: Assuming a mortgage may be a more accessible option for buyers who may not meet the stringent credit or income requirements associated with obtaining a new mortgage. As long as the buyer meets the lender’s criteria and is approved for the assumption, they can acquire the property without needing to qualify for a new loan. This process is often more streamlined and requires less paperwork.

Easier Sale & Higher Prices for Sellers: In a market where rates are 22-year highs, there can be buyer hesitation. Being able to offer a significantly lower rate to buyers can be extremely attractive and help a seller tempt buyers to choose your home over another. Because the seller is endowing the buyer with such a low rate, they can demand a higher sale price.

Disadvantages of Assumable Loans

Large Down Payment: Rising home values can really affect the advantages of a mortgage assumption. When a buyer assumes a mortgage, they inherit the low rate and low payment, but they are also responsible for paying the seller the difference between the value of the home and the remaining balance. For example, a couple buys a home and takes a loan out for $200,000. Today, they have a remaining balance of $150,000, but their home value has risen to $250,000. In an assumable mortgage, the buyers will take responsibility for the remaining balance of $150,000, but they now also owe the sellers $100,000. In many cases, that means getting a second mortgage, which carries the normal closing costs and higher rates – this may negate the benefit of the assumable loans’ lower rate.

Increased Financial Risk: Sellers are often at a higher financial risk with an assumable mortgage, especially one that involves a VA loan. If the lender does not release the original borrower from liability of the mortgage, any missed payments could affect the sellers.

Alternative Options to an Assumable Mortgage

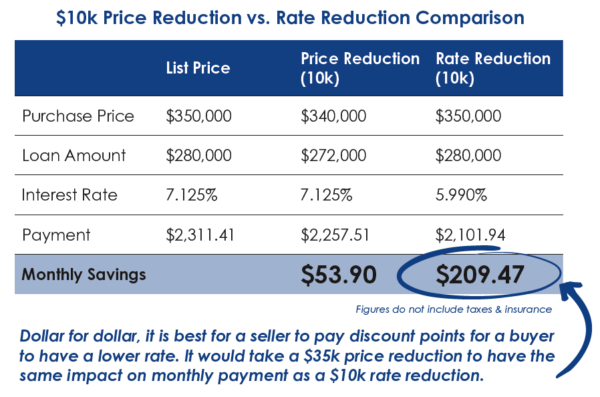

If a lower interest rate is what you’re after, there are other options for buyers in today’s market. The most advantageous of which is the permanent rate buydown. In this scenario, the seller agrees to contribute financially to reduce the buyer’s interest rate, making homeownership more affordable for the buyer. These funds are typically provided at closing and ‘buy down’ the rate for the life of the mortgage. There is also the possibility of a temporary buydown. If a seller is thinking of lowering the price of their home to attract more buyers, it’s more advantageous for them and for a buyer to lower their rate through a buydown. Don’t let high rates deter you from buying.

Marry the House, Date the Rate

We like to remind our borrowers that while the sticker shock of interest rates today may be extra jarring, it’s important to remember that it might not pay to wait for rates to come down. While it may seem crazy, higher rates can work to your advantage when shopping for a home. With home prices on the rise, any downward movement in rates will cause more interest and competition from buyers. Remember, it’s more important to find the right home for you now (marry the house) since you can always refinance to drop your rate when the rates go down (date the rate).

The Bottom Line

Assumable mortgage loans can offer an attractive alternative to traditional mortgage financing. They can provide buyers with lower interest rates, reduced closing costs, and a quicker approval process. Sellers can use assumable mortgages to make their properties more appealing to a wider range of buyers or investors.

However, it’s important to note that not all mortgages are assumable, and assuming a mortgage still requires a thorough financial assessment and approval process. While they are a good tool to have in your kit, there are other options for those looking to secure lower rates or attract more buyers. Therefore, whether you’re a buyer, seller, or investor, it’s crucial to consult with a knowledgeable loan advisor to determine if an assumable mortgage is the right choice for your specific situation.