If you’re getting ready to purchase a house, take advantage and use your tax refund to buy a home and cover some of the costs. You’ll be facing several expenses, and for most borrowers, coming up with all the needed money might be a challenge. That’s why you should earmark your tax refund as “house money,”

Use Your Tax Refund for Down Payment on House

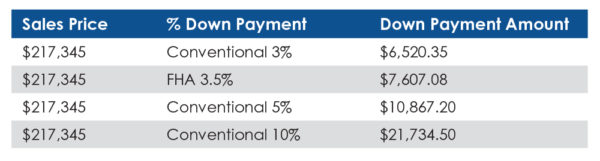

According to CNBC, for the tax year 2021, the average tax refund was $3,536. As of February 2022, Zillow has the average home value in Missouri at $217,345. So, if you were using your income tax return for a down payment on a house in Missouri, here’s how far it could go:

VA and USDA loans have zero-down programs, so in that case, you can use your tax refunds for other fees. Let’s see what they are.

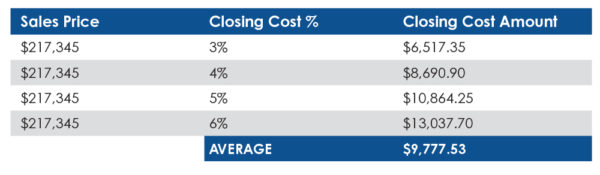

Use Your Tax Refund for Closing Costs

Closing costs range between 3-6% of the purchase price. These fees are based on state, loan type, and lender. There are property taxes and loan-specific fees – for example, a VA loan will have fees that a conventional or FHA won’t have and vice versa.

Title company fees can vary slightly, and then there are lender fees. When shopping around for a loan, it’s good to compare lender fees. The other fees (taxes and loan program fees) should be constant from lender to lender.

Here are examples of closing cost amounts:

As you can see, there is quite a difference in closing costs. Not to worry, however. Your Homestead loan officer can give you a general idea of what you can expect before you start shopping based on your loan program. Then once you find a home you want to put an offer on, they can give you a more exact estimate based on the address and property taxes.

Also, ask your loan officer about seller concessions. Although they may not work in a hot seller’s market, the seller may be willing to pay for some of your closing costs in a slower buyers’ market.

Down Payment Funds – Sourced & Seasoned

Your lender will ask for two months of recent bank statements when purchasing a home. Besides regular and recurring income, they’re also looking for any large unexplained deposits.

Your lender will require that your down payment funds are “sourced and seasoned.” That means you must prove where the money came from. Plus, the funds have to “season” in your account for 60 days. They want to make sure you didn’t borrow the money and have to pay it back.

That’s why it’s vital not to deposit a large chunk of cash into your bank account during the mortgage process. Because if you do – we’ll have to ask so many questions like:

- What was it for?

- Where did it come from?

- Was the money a loan?

- Do you have to pay it back?

But here is some good news about tax refunds.

The Source of a Tax Refund is Easily Identifiable

If you get a tax refund and it’s deposited into your account – you’ll be able to show it was from the IRS. If you get a paper check and deposit it – make sure to make a copy of the check and deposit to prove it was from the IRS.

Since a tax refund is easy to identify – using that money for your down payment would be acceptable even if the money hasn’t been in your account for 60 days.

Be Smart – Use Your Tax Refund to Buy a Home

When it comes to saving up money for a home, a tax refund can go a long way. Contact Homestead Financial Mortgage today. We can go over how much you’ll need for a down payment and closing costs and get you approved quickly.