For most, buying a home will be one of the most expensive purchases of their lifetime. It’s natural for most of us to look for ways to help reduce the burden of that cost. When buying a home, there are two parts to your mortgage payment: principal and interest. Depending on the state of the market and personal factors like your credit score, history, and amount of debt, your lender will determine what your interest rate will be on the purchase you’re making.

Whether rates are high or not, you will quickly be introduced to many new terms, including mortgage points. These kinds of points play a significant role in determining the cost of your mortgage. We will break down what mortgage points are, how they can help you buy down your interest rate, what the cost can look like, and whether or not they are tax deductible.

What are mortgage points?

Mortgage points, also often known as discount points, are a form of prepaid interest that is paid at the time of closing in exchange for a lower interest rate on your mortgage loan. Essentially, you are paying a fee to buy down your interest rate. These can be bought for new purchases or for refinances.

If you buy a home at current rates and choose not to buy down your rate, you are receiving a zero-point mortgage. As the name suggests, there is no upfront payment of discount points. We’ll touch on the pros and cons of buying down your rate in a bit.

How much does it cost to buy down your mortgage rate?

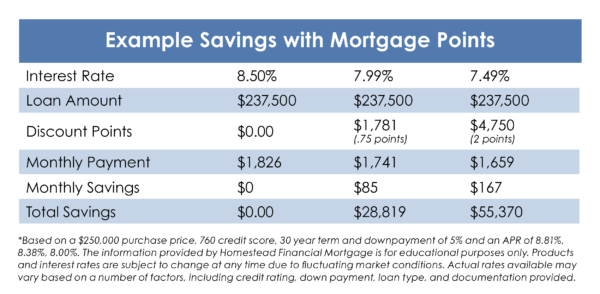

Typically, each point that a borrower buys costs 1 percent of the mortgage amount. For example, if you’re borrowing $200,000, purchasing one discount point would cost $2,000 (1% of the loan amount) and might reduce your interest rate by around 0.25%. You can buy a fraction of a point or up to as many as 3 points, depending on the situation. Discounts can vary by lender and are determined by factors like the state of the market and your creditworthiness.

Mortgage points are paid at closing and will be added to your other closing costs. However, using seller concessions can help offset that cost for a buyer, so they will need to bring less cash to closing. A seller-paid rate buydown, especially in situations where the seller is considering lowering the asking price of a home, can have substantial benefits for both the seller and the buyer.

High mortgage rates can really sideline buyers and sellers, but we encourage you not to let higher rates deter you from buying or selling. There are things that your mortgage lender can do to help make the process easier and offer you more options when it comes to the cost of a mortgage.

Mortgage Points vs. Origination Points

It’s important to keep in mind that Mortgage Points are different than Mortgage Origination Points. Origination points refer to the fees that come from the lender to cover the process of securing your mortgage loan. Often, these fees are a part of what most people commonly know as closing costs, and these are due at closing. Mortgage Origination points do not affect your interest rate.

Pros and Cons of Buying Mortgage Points

Each borrower and home loan will be in a unique situation, but here are some general guidelines to follow when considering the cost of mortgage points.

Length of Stay

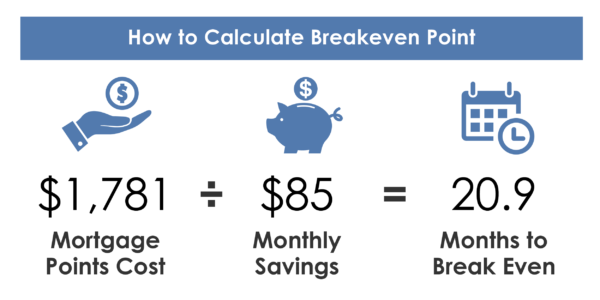

If you are planning on staying in your home for a long time, it might make more sense to invest in points and lower your rate. Buying your rate down can lower the overall cost of your mortgage the longer you are paying on it. If you plan on being in your home for a shorter amount of time, the time it would take you to break even on that upfront cost might be greater than the time you plan on staying in the home – in which case a buydown might not make sense. If you plan on making extra payments to your mortgage every month, this can also weigh in on whether buying points make sense for you.

Who is paying for the points?

If you can work with your realtor and the seller to secure seller concessions to help buy down your rate, taking a seller-paid buydown will financially benefit you much more than if that seller lowers the sale price of the home. Any seller-paid closing costs or points can truly make a huge difference for potential buyers. Purchasing points out of pocket also might not make sense for those buyers with limited funds for upfront costs.

Monthly Mortgage Payment

If you are in a market where rates are high, buying down your rate can save you serious money. It can mean the difference of hundreds of dollars a month on your mortgage payment. Lower interest rates will equal lower monthly payments, and for most, this difference will determine their ability to afford to purchase a home. Lower monthly payments help increase cash flow, but also, if you are in your home long enough, it can really save you money over the life of the loan.

Are points on a mortgage tax deductible?

Buying points on a mortgage may be tax-deductible. Mortgage interest is tax-deductible; therefore, since discount points are considered prepaid interest, they might be something you can deduct on your taxes.

Deductible Points

- The loan is secured by your primary residence.

- The points were an established percentage of the loan amount.

- The points were used to reduce the interest rate.

Non-Deductible Points

Points paid on loans for secondary residences or investment properties typically cannot be deducted in the year they were paid but may be deductible over the life of the loan.

You can read more about tax-deductible mortgage points on the IRS website here. If you have any questions, it’s always a good idea to check with your loan advisor or a tax professional.

The Bottom Line

Ultimately buying mortgage points may make sense for some borrowers, while not for others. This is why it’s important to work with a good lender like Homestead Financial Mortgage so we can sit down with you and walk through your numbers to make sure it is the right decision for your situation. While many folks are wondering when the Fed will lower interest rates and if they should wait to buy a home, we think it is possible that you might actually want higher rates when you’re shopping for a home. In our current market, higher rates will help keep the competition and home prices down. Using a buydown can help keep your rates lower, so if you’re on the fence or want to learn more about your options, please reach out—we’re here 24/7 to help.