Written by:

Alicia Bergfeld – Loan Advisor – (636) 256-5703

Alicia Bergfeld – Loan Advisor – (636) 256-5703

Are you looking to save a whole lotta money just by changing the WAY you pay your mortgage? For many, a mortgage is the most significant debt they’ll ever undertake. It’s natural to want to find ways to pay it off faster and ease the large monthly financial commitment. One strategy gaining popularity is the bi-weekly mortgage payment plan. Paying bi-weekly mortgage payments can shave an average of 5 years off your loan – saving you tens of thousands of dollars! We’ll break down what bi-weekly payments are and if they are right for you.

Understanding Bi-Weekly Payments

Traditionally, mortgages are structured with monthly payments. However, bi-weekly payments involve making half of your monthly mortgage payment every two weeks. This seemingly small adjustment can lead to significant benefits over the life of your loan. By making bi-weekly payments yearly, you will add one extra month’s payment that will be applied to your mortgage principal.

How Bi-Weekly Payments Work

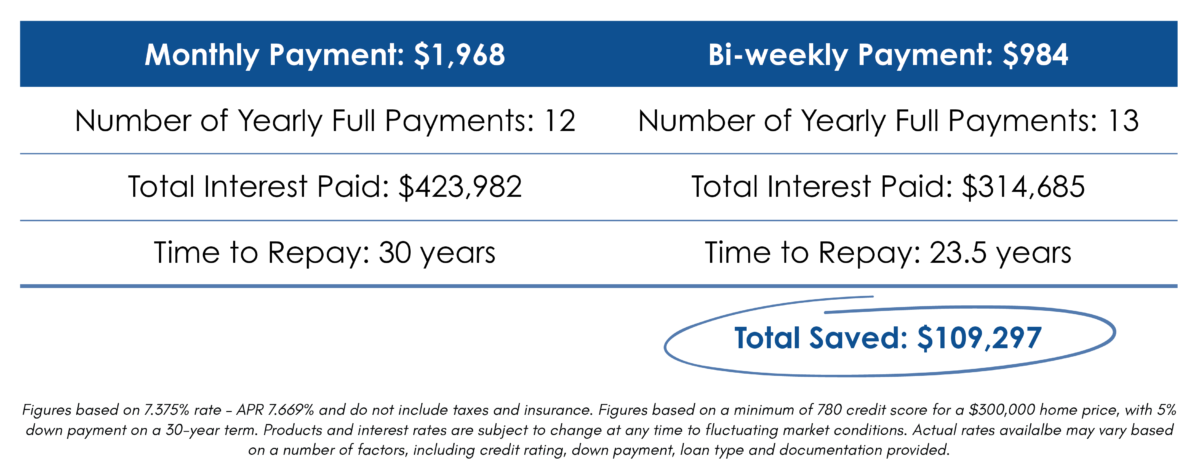

The mechanics behind bi-weekly are pretty straightforward. Instead of making one monthly payment, you take your monthly payment, split it in half, and make that payment every 2 weeks. Because a year has 52 weeks, this works out to 26 bi-weekly payments, making for 13 full payments instead of 12. That one extra payment a year adds up. Since you are paying down your principal faster, there is less money to charge interest on. For example*, if you have a $300k home at a 7.375% interest rate, the bi-weekly payments will take off 6 and half years or a total of $109,297 in interest saved in your pocket!

Benefits of Bi-Weekly Payments

- Accelerated Debt Payoff: The extra payment each year reduces the principal balance faster, which means less interest accrues over time. This can shorten your loan term and potentially save you thousands of dollars in interest.

- Interest Savings: Because you’re paying down the principal balance quicker, you’ll pay less interest over the life of the loan.

- Budget-Friendly: Bi-weekly payments align well with many people’s pay schedules. It’s often easier to manage smaller, more frequent payments than one large sum each month.

- Forced Discipline: Bi-weekly payments enforce a disciplined approach to mortgage repayment, helping you stay on track with your financial goals.

Potential Drawbacks of Bi-Weekly Payments

- Higher Expenses: the added payment over the year can be tough if your budget is tight and that money might be better spent elsewhere. Before committing to accelerated payments, it’s best to ensure you have sufficient savings and aren’t neglecting higher-interest debt.

- Additional Fees: Setting up bi-weekly payments might mean additional fees. If your lender doesn’t offer a bi-weekly payment option, third-party payment processors can be used but may charge extra fees. Some lenders might also charge prepayment penalties.

- Alternative Investments: While paying your mortgage off quicker and saving on interest might seem like a smart financial move, depending on your financial goals and situation, investing your extra money might prove to earn you more money over time.

Alternatives to Bi-Weekly Payments

Similar to a bi-weekly plan is a bi-monthly payment plan. With a bi-monthly mortgage plan, half of the scheduled monthly payment is made twice a month. These are typically set up to be paid on the 1st and 15th of each month, resulting in 24 payments made annually. Breaking up the payments like this will cut down on interest over the life of the mortgage. However, not all lenders will allow bi-monthly payments. If a lender does offer a bi-monthly mortgage plan, they might require additional fees to participate, which could eliminate any potential savings that could have been gained. As with anything, it’s important to do your research.

You can also commit to making an extra payment whenever the timing suits you best, like when you receive a bonus or around tax season when you have an influx of cash. In this situation, you will want to make sure your extra payment is going toward the principal of the mortgage.

A refinance might also be a good option for those who are a little further into their mortgage term and have some equity built up in their home. Depending on your situation, you can potentially consolidate debt to increase your cash flow or use a rate and term refinance to take your mortgage from a 30-year term to a 15-year term to save on interest by shortening the term of your loan.

Bi-weekly payments can be a great option for homeowners looking to not only save money by paying off their mortgage faster but also put themselves on a more manageable monthly budget. By making small adjustments, you could shave years off your mortgage. It’s best to speak with your lender to review all your options to determine what will best fit your unique financial situation. Our experienced lenders are here to help you find the right balance between debt repayment and your overall financial goals.

* Figures based on 7.375% rate – APR 7.669% and do not include taxes and insurance. Figures based on a minimum of 780 credit score for a $300,000 home price, with 5% down payment on a 30-year term. Products and interest rates are subject to change at any time to fluctuating market conditions. Actual rates availalbe may vary based on a number of factors, including credit rating, down payment, loan type and documentation provided.