“I want to go out and acquire a lot of credit card debt at really high-interest rates.” … said no one ever.

However, life happens. There are job layoffs, illness/injury, or sometimes just a run of bad luck.

We are all trying to figure out how to handle what life throws our way. This article will cover some common questions for when you’re considering a debt consolidation home loan. Then, we’ll discuss how you should choose a good lender to accommodate that request.

Should you consider a debt consolidation mortgage loan?

Does the expression “too much month left at the end of your money” feel familiar? This expression means that you have a large amount of debt which is affecting your monthly cash flow, and you are not alone. You may be living paycheck to paycheck, and that can affect your quality of life. If you are in this situation and feeling the monthly strain of a tight budget, it might be time to consider a debt consolidation mortgage.

What is a debt consolidation mortgage loan?

A debt consolidation mortgage – also known as a credit card consolidation home loan is when you take out a mortgage to pay off credit card debt. These home loans can be either a 1st mortgage or a 2nd mortgage. A first mortgage is the primary loan typically used to pay for your home. When you refinance your home, you are typically refinancing your first mortgage. A second mortgage is taken, in addition to the first, against your home’s equity. Home equity lines of credit (HELOCs) are often used as second mortgages.

You would take out a second mortgage or refinance your first because credit cards have shockingly high-interest rates. As of August 2023, the average credit card rate per creditcards.com is above 20%. However, mortgages have much lower interest rates. This is why people explore paying off debt from a credit card with a mortgage.

Do you have more than $20,000 of credit card debt?

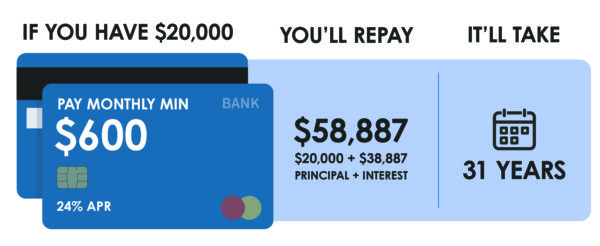

Let’s take $20,000 of credit card debt or personal loans as an example – this can cause a significant strain on your budget. Assuming that 3% of the balance is the payment, a minimum payment of $600 is added to your monthly budget. Paying the minimum on this debt can take 31 years and cost an additional $38,887 in interest.

Is the credit card debt over 50% of your credit limit?

Credit cards have always been a way to handle purchases in an emergency. If your credit card balance is more than half of your limit, you should be cautious about running out of credit. It’s also important to keep your credit utilization below 30% to help keep your credit score in good standing. Credit utilization makes up about 30% of your credit score, so it’s also important to keep that in mind.

Worrying about hurting your credit score?

If you are up against your credit limits and struggling to make minimum payments – be aware that should there be any late payments on the accounts, it may make future financing unattainable. Missing payments on credit cards that are maxed out can potentially have a greater impact than missing those on cards with lower balances. Getting stuck in a position of playing catch up on payments can be one that is hard to get out of. The impacts of a good or bad credit score can play a big part in your financial future.

Will consolidating debt improve your monthly cash flow?

We break down the numbers to help you get a basic idea of how much you can save. But ultimately, knowing if a debt consolidation loan can help your bottom line will require a good lender to give you an accurate proposal and disclosures.

If the above items sound familiar, you should consider finding a good debt consolidation mortgage lender.

Choosing the Best Lender for a Debt Consolidation Mortgage

Start your journey by reaching out to a lender you trust. If you don’t already have one, here are some tips to help you make the best choice. Remember, a debt consolidation loan is technically a cash-out refinance mortgage. So, the terms will appear interchangeably when you’re doing your research.

Check out reviews.

A great lender will have a lot of reviews that indicate they provide great service. Reviews should look organic and natural. There should be a long history of reviews from actual people.

For example, you can find Homestead’s Google reviews here. You can also search specific lenders on Zillow to see their reviews there. Reading about others’ experiences with a lender can really give you insight into how your experience should go.

A good lender won’t ask you to cut a check for services rendered.

Think about this… If you need to save money, then a good lender won’t ask you to spend it.

A good lender doesn’t benefit from wasting their time or the customer’s time. A good mortgage lender will clearly lay out the pros and cons of consolidating your credit cards into a mortgage. After talking with a lender and reviewing your situation, it’s safe to expect that they will not push you to apply unless they are confident you will be approved.

A good lender should also be confident enough in the services they provide to wait to collect any money from you until the loan closes. It should not cost you anything to apply. With Homestead Financial Mortgage, it costs Nothing Out of Pocket (NOOP) to apply.

A good lender will give you disclosures as well as an analysis of your scenario.

You will need to get a Loan Estimate (LE) and Uniform Residential Loan Application (1003). However, federally mandated disclosures do very little to analyze improved cash flow. Expect a good lender to give monthly payments with before and after figures to really help you see what you can save.

Homestead Financial Mortgage uses a Letter of Proposed Accomplishments (LOPA) to analyze the mortgage transaction for Net Tangible Benefit (NTB). This document explains how a cash-out mortgage can help the customer pay off their credit cards.

A good lender will offer technology to make the process simple.

It is true that any borrower with a smartphone can get a mortgage from their couch! In very few industries has technology helped more than in the mortgage industry. Technology has made everything that people have hated about getting a mortgage easier.

For example, you can use your smartphone to:

- Apply for a mortgage. While we should talk about your goals at some point, you can apply online before speaking with a Loan Officer.

- Send in supporting documents. Items like paystubs, W2s, and bank statements can all be provided digitally.

- Sign disclosures. No matter your location, you can sign the application documents like the LO or 1003. These documents are accessible from your smartphone and will be on file for review.

A lender who has already invested in customer satisfaction should have this technology. Great technology makes the process seamless.

In conclusion:

If you need to consolidate credit card debt into a mortgage, carefully assess your situation and find a great mortgage lender. Make sure that lender has great reviews and a great system to make the process seamless. Give us a call and see how we can help take some financial burden off your monthly expenses.