The American dream of home ownership has long been a cornerstone of our country. Yet, for many, this dream has only been achievable through the assistance of mortgages. The concept of borrowing money to buy property has a rich and fascinating history intertwined with economic developments, government interventions, and societal changes. In this blog post, we embark on a journey through time to explore the evolution of home mortgages and the fluctuating landscape of mortgage interest rates.

The Dawn of Mortgages: Early Beginnings

Believe it or not, the origins of mortgages can be traced back to ancient civilizations such as Mesopotamia and ancient Rome, where land was used as collateral for loans. However, the modern concept of mortgages began to take shape in England during the Middle Ages.

In the early days of America, land ownership was predominantly reserved for the wealthy elite. However, the emergence of mortgages played a pivotal role in expanding homeownership to a broader population.

The Great Depression and the Rise of Federal Intervention

Until the founding of the Federal Housing Administration in 1934, only one in 10 Americans owned a home. The turmoil of the Great Depression brought about significant changes to the mortgage market. Widespread foreclosures and a collapse in housing prices led to the creation of agencies like the Federal Housing Administration (FHA), Fannie Mae, and Freddie Mac. These agencies aimed to stabilize the housing market by providing government-backed mortgages and introducing standardized lending practices.

Post-War Boom and the Suburbanization of America

The years following World War II witnessed a surge in homeownership as returning veterans took advantage of government programs such as the GI Bill and Federal Housing Administration loans. This era also saw the rise of suburbia, fueled by affordable mortgages and the construction of mass-produced homes. The 30-year fixed-rate mortgage became the standard, offering homeowners predictable monthly payments, making the American Dream possible for millions.

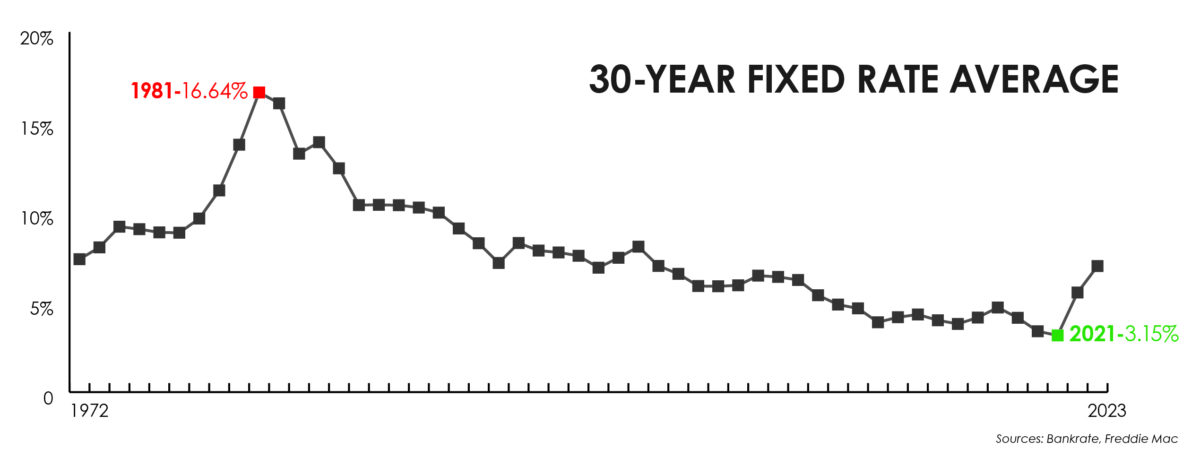

After the war, we began to see trends in Mortgage Rates take shape. At the start of 1971, the rate on a 30-year fixed-rate mortgage was 7.3%. But by 1979, the rate had jumped to 12.9%. During this time period, various Federal Reserve policies and factors made inflation go up and, with that, borrowing costs. With rising housing costs, the 30-year fixed mortgage rate reached an all-time high of 18.4% in October 1981.

Mortgage rates are intricately tied to economic factors, notably influenced by central bank policies, employment levels, GDP growth, and investor sentiment. Central banks’ decisions on interest rates directly affect borrowing costs. Lowering rates stimulates demand for housing by making mortgages cheaper, while raising rates can cool down an overheated market. Economic indicators like GDP and employment levels also influence mortgage rates, with strong economic performance typically leading to higher rates as investors seek better returns. Conversely, rates often decrease during economic downturns as investors turn to safer assets like government bonds, driving down mortgage rates.

The dot-com bubble saw a rush of investors buying stocks in technology companies, and when those stocks tanked, those investors brought their money to fixed-income investments like bonds. As bond prices rose and yields fell, mortgages, which followed the 10-year Treasury’s yield, also declined.

The Mortgage Crisis of 2008 and Its Aftermath

The early 21st century brought unprecedented growth in the housing market, fueled by lax lending standards and a proliferation of subprime mortgages. However, this housing bubble burst in 2008, triggering a global financial crisis. Foreclosures soared, home values plummeted, and many mortgage lenders collapsed. In response, governments implemented various measures to stabilize the housing market, including quantitative easing and mortgage relief programs. Mortgage Rates during this time went from about 8% at the start of the decade to 5.4% in 2009.

The Current Mortgage Landscape

Between 2010-2020, rates continued to decline and stayed around the 4% mark. The Federal Reserve pulled back on bond buying, and rates dropped. In recent years, mortgage interest rates have experienced historic lows, driven by factors such as monetary policy, economic conditions, and investor demand for safe assets. Amid the pandemic, rates hit historic lows in the 2-3% range as investors again were attracted to safer products and pushed yields and rates lower. The Federal Reserve’s efforts to stimulate the economy through low interest rates have resulted in favorable borrowing conditions for homebuyers.

In 2022 and 2023, the Federal Reserve began raising its rates in an effort to curb high inflation, and mortgage rates followed suit. However, the future trajectory of mortgage rates remains uncertain, with potential inflationary pressures, an upcoming presidential election, and global market fluctuations on the horizon.

Future of Mortgage Rates

The history of home mortgages and mortgage interest rates is a testament to the dynamic nature of the housing market and its profound impact on society. The last 50 years have shown that rates are indeed cyclical and that, really, the only constant in life is change. While there are some market indicators that experts use to gauge what will happen with rates, it is hard for anyone to know for sure when that will be. History shows us that rates certainly can climb even higher, but they can and will go down.

Despite high rates, home prices continue to get higher and higher. Currently, Baby Boomers are still the largest demographic of homeowners – and they are not showing signs of making any moves. Surveys show that one in five Millennials believe they will never own a home, and one in 10 from Gen-Z think the same. We break down if/when home prices will drop, but it’s important to remember that the saturated home-buying market will get even MORE competitive when rates are lower. Right now, you may want higher rates when shopping for a home.

Understanding the historical context of mortgages can help us navigate the complexities of the housing market and provide valuable insights into current trends and future developments. At Homestead Financial Mortgage, we can help no matter what is going on with rates. If you’re shopping, we can help you secure a rate up to 2% lower than the market, or if you are a homeowner with credit card debt that’s beginning to weigh you down, we can help you refinance and consolidate your debt. Even in a market with higher rates, you can still benefit from a debt consolidation refinance. No matter your situation, our mortgage experts are here to help you and your family make the best decisions for your situation.