Many people buy their first home thinking the story ends when they close and start making payments on their loan—Nice, predictable monthly payments. But sometimes, that housing payment can change, leaving homeowners confused and scrambling to adjust budgets.

What does your mortgage payment cover?

A typical mortgage payment encompasses two primary components: the loan payment, which covers the principal and interest on the mortgage loan, and an escrow payment, which contributes to an escrow account. An escrow account acts as a centralized fund managed by the mortgage servicer to cover various homeownership-related expenses, such as property taxes, homeowners’ insurance, and, in some cases, mortgage insurance or homeowners association fees.

Rather than handling these expenses separately, homeowners make a single monthly payment to their mortgage lender, which includes both the loan payment and a portion allocated to the escrow account. When bills for property taxes or insurance premiums are due, the lender withdraws funds from the escrow account to pay them on behalf of the homeowner. This setup ensures that these critical expenses are covered in a timely manner, providing financial stability and peace of mind for both the homeowner and the lender.

Why does your mortgage payment go up?

If your house payment increased due to changes in your escrow balance, it typically involves one or more of the following factors:

- Property Tax Adjustments: Property taxes can increase due to higher property valuations or rate changes by local government entities. If the taxes required to be paid from your escrow account go up, your lender will collect more each month to cover these higher costs.

- Homeowners Insurance Premiums: If your homeowners’ insurance premium rises—perhaps due to a change in policy, an increase in coverage, or insurer rate adjustments—your escrow payment needs to accommodate this increase to ensure enough funds are available for the annual premium payment.

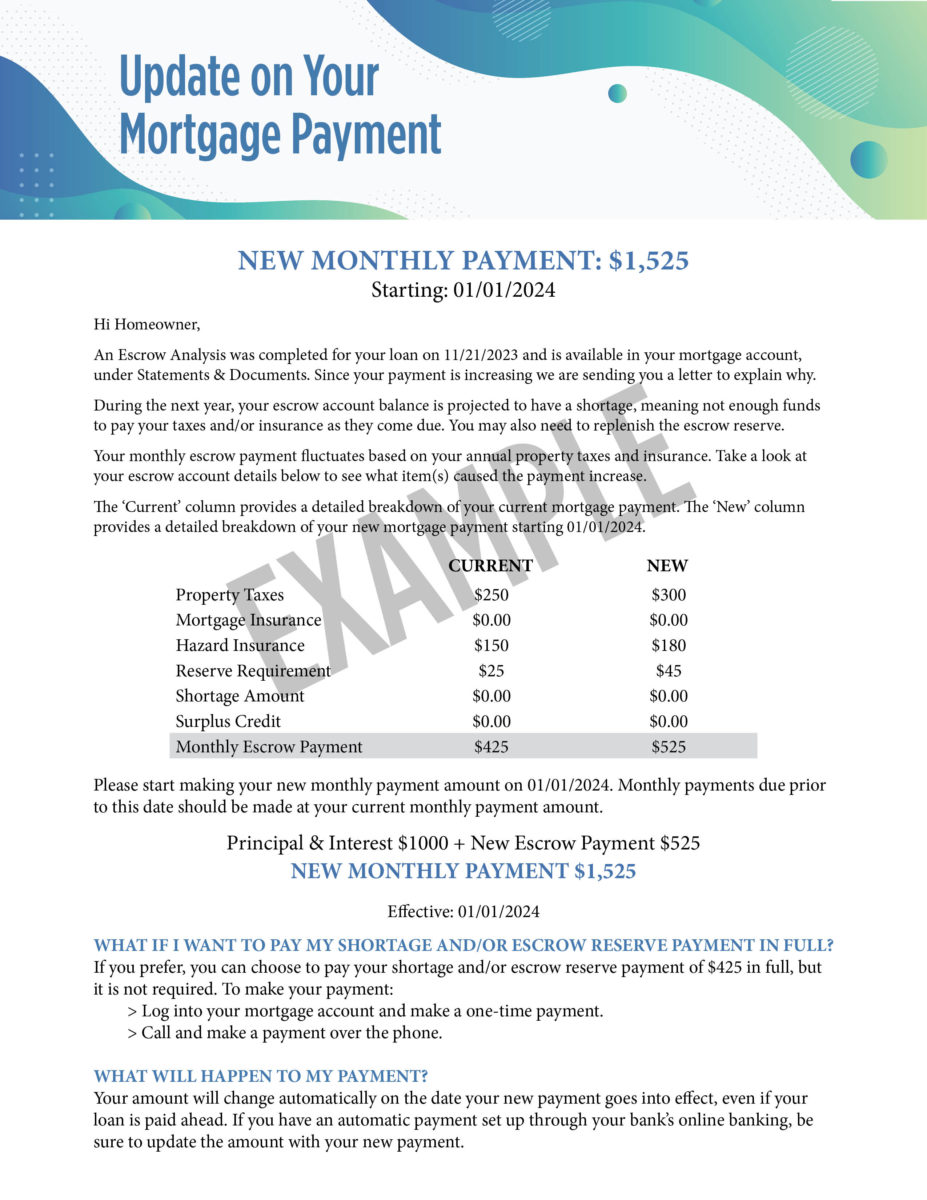

- Escrow Shortage: Each year, lenders perform an escrow analysis to ensure that the amount being escrowed is sufficient to cover tax and insurance obligations. If the previous year’s escrow was underfunded (meaning the actual expenses exceeded the estimated amounts collected), your lender will typically spread out the shortage amount over the next year’s payments.

- Escrow Cushion Adjustments: Lenders often require a cushion (usually about two months of escrow payments) to cover unforeseen increases in taxes or insurance. If this cushion wasn’t adequately maintained according to regulations, they might adjust your escrow payment to rebuild this cushion.

It’s important to note that when any of these costs are higher than expected, your lender takes the necessary steps to adjust your monthly escrow payment. You will receive a statement informing you of any changes and what your expected shortage is. You will have the option to pay that shortage with a one-time payment, allowing your monthly mortgage payment to remain the same, or your monthly payments can be adjusted going forward. If you do not respond, your lender will make the monthly payment adjustment to ensure all expenses are covered, which results in an overall increase in your monthly mortgage payment.

Can your monthly payment go down?

This isn’t something that will automatically happen, but when you remove mortgage insurance, your payment can drop. You will always carry homeowner’s insurance, but depending on your loan type and the amount of down payment you put down, homeowners often will have Mortgage Insurance or Private Mortgage Insurance attached to their loan.

For instance, if you have a conventional loan and you put down less than 20% when you purchased your home, you will be paying private mortgage insurance (PMI) each month. Once you reach 20% equity in your home, you can request that your servicer remove PMI. This will auto-cancel at 22% or the midpoint of your mortgage term, but you can call and request removal once you’ve reached 20% equity.

Is a refinance right for you?

Credit balances are going up. Savings are going down. People’s budgets are tighter than they ever have been. If you find yourself in a situation where you could use more cash in your month, it might be time to explore your refinance options.

If you find these changes surprising or hard to manage, discussing them with your lender or reviewing your escrow statement to understand and plan for these fluctuations is a good idea. Additionally, our Loan Advisors at Homestead Financial Mortgage have options that may decrease your mortgage payment. Reach out to our team for a FREE Mortgage Review—It could possibly save you money each month!